News

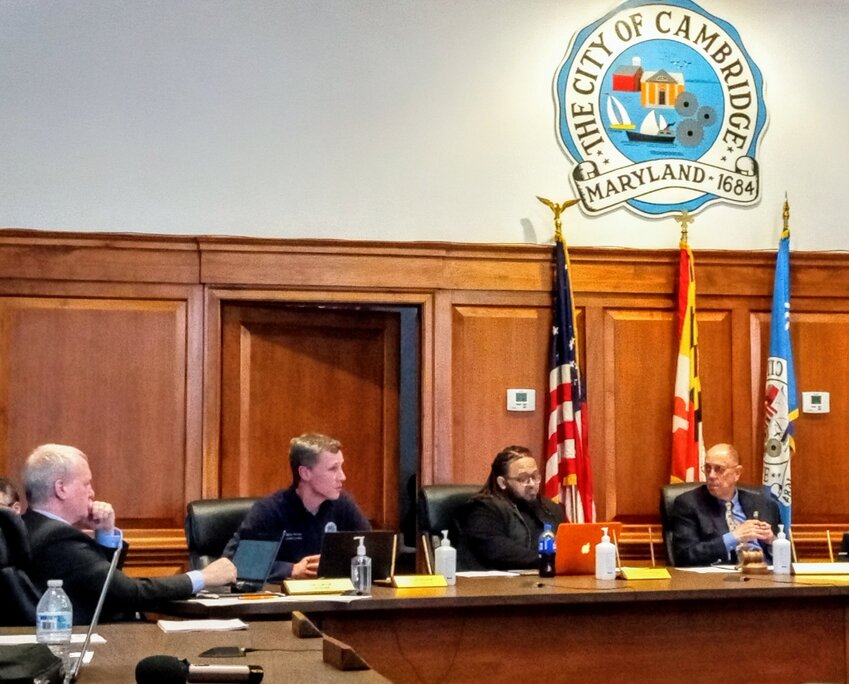

During its April 22 meeting Cambridge City Council approved the selection of Shore Construction LLC, the lowest of four bidders, for contracting work repairing the city’s plethora of sidewalks needing repair.

The governing body of the Cambridge Harbor development, which has come under fire in recent weeks following the resignation of City Manager Tom Carroll, has posted two streaming links to its community update meeting Wednesday.

Cambridge Mayor Steve Rideout took steps to assert city oversight into Cambridge Harbor activities with the introduction of amended articles of incorporation for Cambridge Waterfront Development, Inc. (CWDI).

Under the revisions, the Mayor of Cambridge would be designated as the nonprofit CWDI’s sole member.

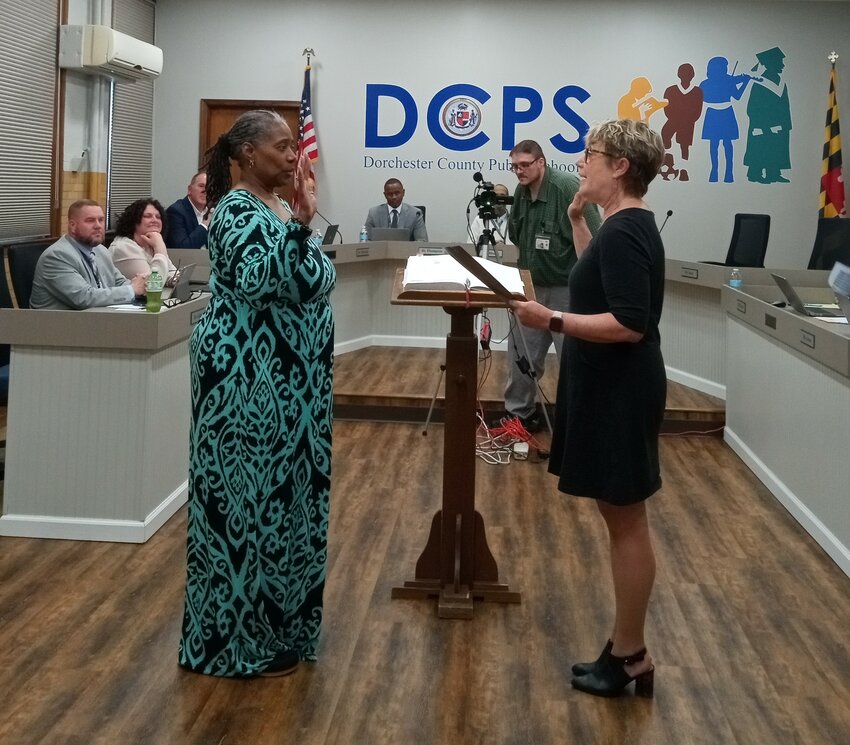

Dorchester County Council recently appointed her to fill the remaining school board term of the late Dr. Theresa Stafford, who passed away in December 2023, representing District 2.

And on …

DUNDALK, Md.— More than 1,000 small businesses have sought emergency federal loans to stay afloat following the March 26 collapse of the Francis Scott Key Bridge and closure of much of the Port …

E-Edition

View this issue of Dorchester Banner or browse other issues.

Sports

CAMBRIDGE – At Cambridge-South Dorchester High School’s home meet April 10, the men earned a win, with a score of 160.5 points. They were followed by Parkside, 67; James M. Bennett, 55.5; …

SHILOH – On April 10, the North Dorchester High School Boys’ Track and Field Team won their meet against Colonel Richardson, Crisfield and Washington with a score of 87.5. Results are …

Over a decade ago Kylie Curtis’ dream of playing soccer at Crisfield High School was nearly impeded by one major obstacle: there was no girls’ team.

The 2012 graduate was 10 years …

Business

Business Insights

CAMBRIDGE – On March 22, U.S. Senator Chris Van Hollen (D-Md.) visited J.M. Clayton Seafood Company to meet with local crab house representatives and discuss efforts to support …

Three Hundred and Fifty Dorchester County Chamber of Commerce members gathered to wine, dine, and be inspired at the Hyatt lChesapeake Thursday, March 21 from 5 to 9 p.m.

The 78th Annual Membership Meeting and Dinner attendees represented a crossroads of the local community. State, County, Cambridge, and Hurlock officials were on hand. So, too, were those from the ranks of large and small businesses, agriculture, service organizations, and the nonprofit community.

Business Insights

The basics of producing corn, soybean, and wheat crops aren’t rocket science to local growers. It’s a way of life, day in and day out, sunup to sundown, year after year.

Cambridge

CAMBRIDGE -- Almost two years after becoming Cambridge City Manager in April 2022, Tom Carroll submitted his resignation due to differences over the direction of the Cambridge Harbor waterfront development project.

ANNAPOLIS — Lawmakers are moving toward consensus on changes to Maryland’s juvenile justice system, discussing how to address crime by children ages 10 to 12 and get them into …

ANNAPOLIS — Maryland’s Democratic-led legislature passed the Blueprint for Maryland’s Future in 2021, vowing to pour billions of dollars into the state’s public schools to …

CAMBRIDGE – If Dorchester County had a Boat Builders Hall of Fame, Neck District natives Captain Jim Richardson and Harold Ruark could have been picked.

These local legends’ legacies …

Neighbors

CHICONE – The Nanticoke Historic Preservation Alliance is sponsoring the 11th Annual Chicone Village Day at Handsell on Indiantown Road in Vienna on April 27, 10 a.m.-5 p.m. This event is …

CAMBRIDGE – Both the Cambridge and Hurlock branches of the Dorchester County Public Library were scheduled to be closed April 16 for a Professional Development Day. We are focusing on …

“Zeta is a verb, as we are a community conscious, action-oriented sisterhood” – Iota Chi Zeta chapter

The Eastern Shore’s single chapter of historic, international …

Things to Do

Call for Artists - 2024 DCA Annual Members’ Show and Sale

CAMBRIDGE – Dorchester Center for the Arts is pleased to announce a call for artists for the 2024 Annual Members’ Show and …

‘Joy Through Art’ is Main Street Gallery’s spring show

CAMBRIDGE – Main Street Gallery is excited to be exhibiting the artwork of Joy Staniforth as its guest artist for the May/June …

Cambridge Farmers Market season underway at Long Wharf

A favorite local sign of Spring, the Cambridge Maryland Farmers at the Choptank opened for the season on April 4 at its Long Wharf …

More Things to Do

Schools

SHILOH – The administration at North Dorchester High School has released the names of students who earned places on the 2023-2024 Quarter 3 Exceptional Honor Roll with 3.5-4.0 grade point …

WESTMINSTER – The Dorchester Career and Technology Center Chapter of SkillsUSA flexed its competitive muscles again April 16 as students traveled to Carroll County Career and Technology Center …

CAMBRIDGE – The Dorchester County Public Schools Board of Education announced last week that as part of the process to select the next superintendent of schools, there will be a series of …

Opinion

The members of the Maryland-Delaware-DC Press Association are deeply concerned about the potential consequences of Maryland House Bill 1258 on local journalism.

I am a concerned Ocean Pines, Maryland, citizen who is appalled by the unsightly litter along our roads and waterways in our otherwise beautiful Eastern Shore. It’s time to actually do something to deal with this issue.

The Alabama Supreme Court, citing Dobbs v. Jackson Women's Health Organization, has ruled that the frozen embryos used in IVF (in vitro fertilization) are children and entitled to all the protections …

Last week's Viewpoint page featured an open letter submitted by the Maryland House Republican Caucus expressing their concerns that a juvenile sex offender convicted of second-degree rape …

As Cambridge Waterfront Development, Inc. (CWDI) advances its mission to develop Cambridge Harbor, we plan to keep the public informed on our progress and what you can look forward to in the coming …

When the opening day of the 2024 Maryland General Assembly session was called to order, Delegate Sheree Sample-Hughes was the speaker pro tempore in the Maryland House of Delegates, the second-highest position for a member of the House Democratic Caucus.